The US-China trade war begin

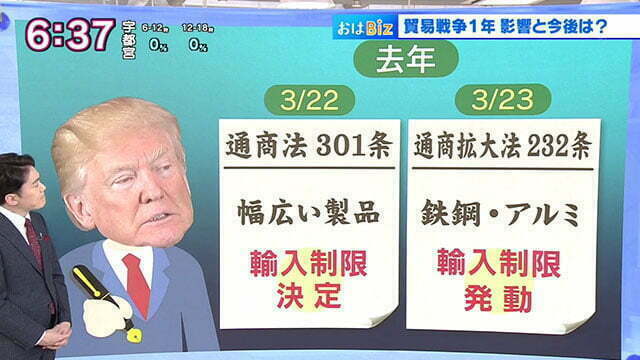

On March 22, 2018, US President Trump decided on China to restrict imports of a wide range of products. And it was March 23, 2018 that the restriction measures for steel products etc. were invoked. It’s been a year since then. What kind of impact is beginning to appear on the world economy?

Sino-US sanctions exchange

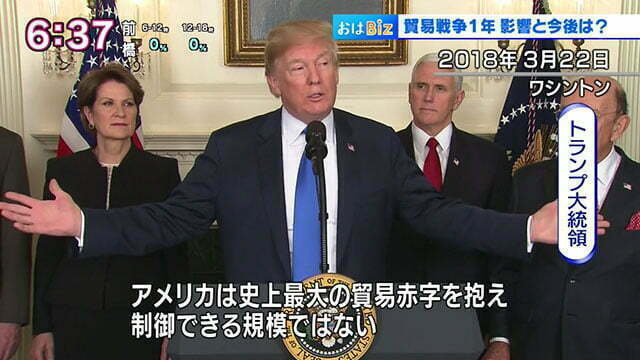

Let’s look back at the trade war between the United States and China from the beginning. President Trump said, “The United States has the largest trade deficit in history and is not on a controllable scale.” First, it imposes import restrictions on steel products and aluminum, citing security reasons. From July to September, China was quickly subject to additional tariffs on the grounds of infringement of intellectual property rights. It made both countries feel more and more nervous.

|

|

The Chinese side also announced countermeasures. “The trade war is arguably the first to damage American consumers, businesses and financial markets,” said Hua Chunying, a spokesman for the Chinese Foreign Ministry. The exchange of sanctions continues.

Today, we visit a Hong Kong based company, Boly Metal Manufactory Ltd. At factories that manufacture machined parts in Shenzhen, China, the effects of trade friction are gradually emerging. At this factory, half of the sales come from transactions with American companies, and most of the transactions are subject to additional tariffs. As a result, orders have decreased by about 15% compared to the previous year.

|

|

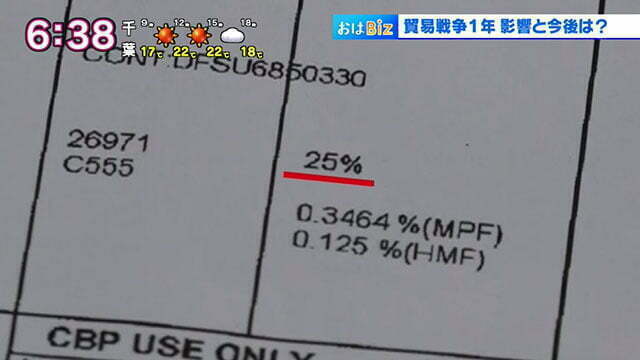

The business partner showed a document stating that the tariff was 25%. “If the trade war continues, U.S customers may move their products outside of China, such as India or Vietnam. Some factories may lose their business from the U.S.A and cause production to shut down.” said the Deputy General Manager, Mr. Vincent Cho of Boly Metal Manufactory Ltd.

|

|

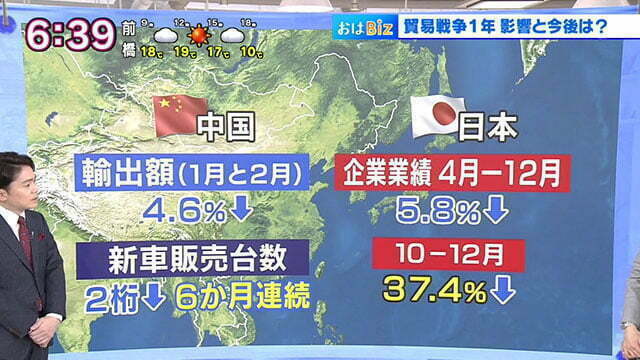

China’s economic slowdown spreads to Japan

When it comes to demanding discounts on tariffs, it is difficult for Chinese companies. The Chinese economy was originally in a double-punched state due to trade friction added to the place where financial regulations became strict and the economy began to slow down. This situation is also reflected in the statistics. Looking at the combined export value of China in January and February 2019, it decreased by 4.6% from the same period of the previous year. In addition, the number of new cars sold has decreased by double digits for 6 consecutive months, and the slowdown in consumption is becoming clear. China’s economic slowdown has spread to Japan. Looking at the financial results for the nine months from April to December 2018 for listed companies in Japan, profits decreased by 5.8%. Moreover, looking only at the third quarter from October to December 2018, a whopping 37.4% decline in profits has put a sharp brake on the market.

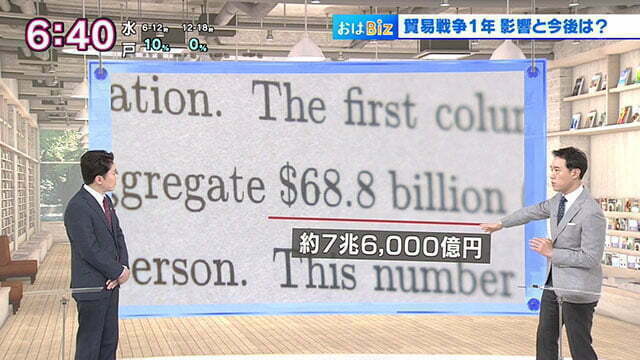

With an annual loss of 7.6 trillion yen in the United States

So what about the American side that is attacking? An interesting treatise was published this month. Economists at the University of California have estimated the loss of the US-China trade conflict. According to the report, the increase in import costs over the past year has resulted in an annual loss of 7.6 trillion yen for consumers and producers. Tariff income is included, but even if it is offset, it is said that the loss is 860 billion yen.

The United States itself is facing a huge economic influence. Then, what will happen to the economies of each country in the future? Now, the United States and China are continuing trade negotiations. From the 28th, ministerial negotiations will resume in Beijing for the first time in a month. It would be nice if this could be settled, but it is said that there is a gap over the check system to see if China will keep its promise. Even if an agreement is reached, President Trump has said that additional tariffs will continue for the foreseeable future, and the global economy is likely to continue to be challenged.